10 Percent: A simple path to financial freedom

Wealthist

Financial insights for everyone

Saving for retirement can feel overwhelming, especially if you don’t have access to a 401(k) through your job. But here’s something that might surprise you: setting aside just 10% of every paycheck could eventually make you a millionaire. That sounds like a stretch, right? But it’s actually pretty doable if you stick with it and put your money in the right place.

Starting Small Can Lead to Big Results

Let’s say you make $60,000 a year. If you save 10% of that, you're putting away $6,000 a year—or about $500 a month. At first, it might not seem like much. But saving that amount consistently can make a huge difference over time.

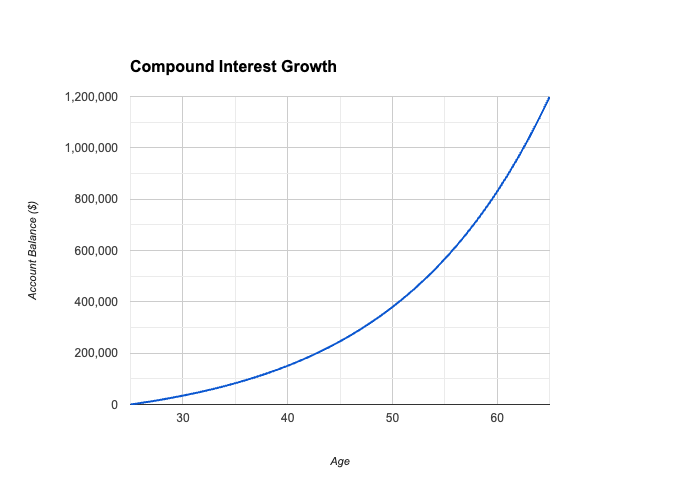

If you keep it up for 30 years, you’ll have saved $180,000. That alone is a great accomplishment. But here’s where it gets even better: when you invest that money, it can grow. A lot. Thanks to compound interest—where you earn interest on your interest—your $180,000 could turn into around $540,000 if your investments earn about 7% a year.

If you keep saving and investing for 40 years, you could hit over $1 million. It’s not about getting rich quick. It’s about sticking to a steady plan and giving your money time to grow.

What If You Don’t Have a 401(k)?

Not everyone has a 401(k), and that’s okay. You still have options. Two of the best ones are IRAs (Individual Retirement Accounts) and regular investment accounts.

With a Traditional IRA, your contributions might reduce your taxes right now, which can be helpful if you're trying to keep more money in your pocket today. But when you take the money out in retirement, you’ll owe taxes on it.

A Roth IRA works a little differently. You pay taxes on the money before you invest it, but then your investments grow tax-free—and you won’t owe any taxes when you withdraw it in retirement. That tax-free growth adds up, especially over decades.

For 2025, you can put up to $7,000 a year into a Roth IRA. If you're 50 or older, the limit jumps to $8,000 so you can catch up.

If you want even more flexibility, look into a personal investment account. These don’t come with tax perks, but you can invest as much as you want and take the money out anytime without penalties. That makes them perfect not only for retirement but for any long-term goals—like buying a home or starting a business.

Make Saving Feel Effortless

One of the easiest ways to save is to automate it. Set up a transfer that moves 10% of your paycheck into your savings or investment account as soon as you get paid. Think of it like a regular bill, just like rent or your phone payment. When it’s automatic, you’re less likely to skip it—and over time, you won’t even miss the money.

Once saving is on autopilot, decide where to put that money. If you qualify for an IRA and want to reduce your taxes, start there. If you’ve already hit your IRA limit, or if you’re focused on long-term growth and flexibility, a personal investment account could be the way to go. Many financial institutions now offer low-cost, automated accounts that make investing easy—tools like Wealthist, for example, can guide you every step of the way.

As your income grows, increase your savings. If you get a raise, try bumping your savings rate to 12% or more. Even small increases can make a big difference over time.

A Real-Life Example

Let’s say you’re 25 and making $60,000 a year. You start saving $500 a month—10% of your salary. If you invest it wisely and earn an average return of 7% per year, you could have over $1.2 million by the time you're 65.

Even if you start later, the key is to build the habit. A late start is still better than no start at all. Just keep going.

Stay Focused and Adjust as You Go

One helpful tip: treat your savings like a non-negotiable bill. Pay yourself first, before rent, groceries, or anything else. If you notice you’re spending money on stuff that doesn’t really bring you joy—like unused subscriptions or frequent takeout—redirect that money into your savings instead.

It also helps to keep an eye on your progress. Seeing your account grow can be incredibly motivating. Tools like Wealthist make it easy to track your savings and stay on course.

The most important thing? Just start. You don’t need a ton of money or fancy knowledge to build a secure future. Start with what you can, stay consistent, and let time do its thing. Your future self will be so glad you did.