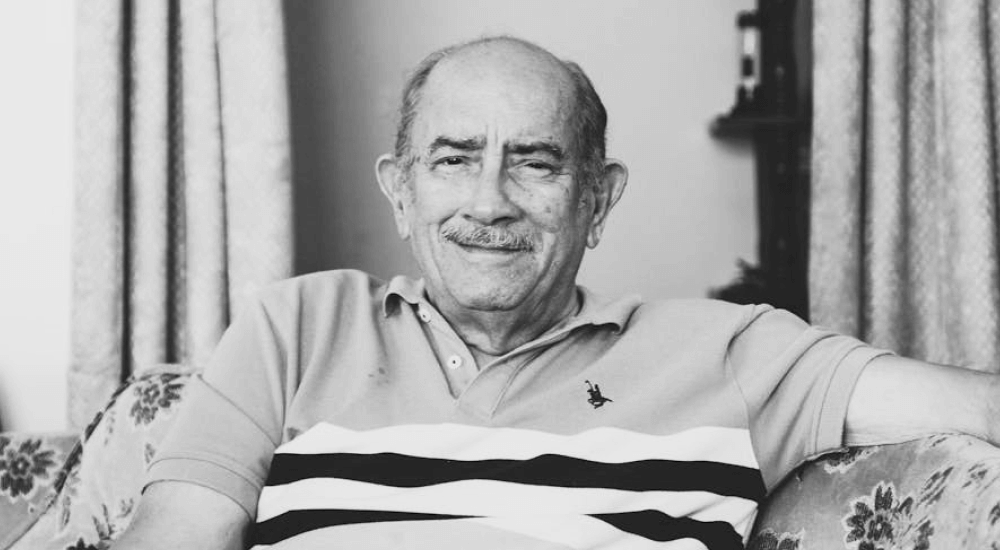

Your grandparents were right about money

Wealthist

Financial insights for everyone

So you're broke? The answer might be coming over for Thanksgiving dinner soon.

Your grandparents had the formula for success and it wasn't side-gigs. It was doing the right thing every day... for a long time. They put their family first and they found joy in the little things in life. They tracked what they spent and didn't complain about inflation on social media. They got up, worked, paid their bills, and kept going. Every day.

Somewhere between then and now, we got soft.

We moved away from common sense and towards the YOLO lifestyle because everyone thought the world was ending. Quick tip: It's not. We made everything sound complicated to avoid doing the simple things that actually work. So let’s get back to the basics... the boring, old-school, effective money habits that built more wealth than half the influencers you follow combined.

1. Work like it’s your job (because it is)

Your grandparents weren’t finding their purpose when they went to work. They were finding a paycheck. They didn’t need passion, ping-pong tables, or cappucino on tap. They showed up, did the work, didn’t whine about it, and came home tired.

Here’s the secret no one wants to hear: doing hard, unglamorous work consistently is still the fastest path to financial stability.

You can’t hack your way out of effort.

2. Spend less than you make. It's not as hard as you think.

Your grandparents didn’t have Netflix, Hulu, HBO, and Disney+. They didn't go out to eat 5 times a week. They didn’t take vacations on credit cards "for the 'gram." . Vacations were mowing the yard without the kids around. They didn’t “deserve” a new iPhone because life was stressful. They deserved heat in the winter because they paid for it.

The math hasn’t changed. If you make $5,000 a month and spend $5,001, you’re broke. No matter how many points you earn or income streams you’ve got.

3. Save first, not last

You know how your grandma always had a little something put away? That wasn’t luck or boomer-math. That was discipline.

They saved before they spent.

They didn’t wait for a bonus or a windfall or some magical moment of clarity.

They just made saving automatic — even when it hurt.

Want to be wealthy? Set aside 20 percent of everything you make. Don’t touch it. Don’t check it. Don’t make it complicated. Just save it and invest it long term. Every month. Forever.

It’s not sexy. It just works.

4. Stop buying $hit you don’t need

Your grandparents didn’t do "retail therapy." They had "we can’t afford that."

They owned fewer things, took better care of them, and didn’t chase things that didn't matter. A pair of shoes lasted until it didn’t. TVs didn't go bad when the new one has slightly blacker blacks.

We’re drowning in stuff and starving for security. The easiest fix is to stop trying to buy happiness. You’ll save thousands by not needing constant validation from Amazon boxes.

5. Don’t try to look rich. Be rich.

Your grandparents weren't flexing on social media. They wouldn't have needed to. They were too busy owning their homes outright, paying off debt, and building actual net worth.

Meanwhile, we’re out here financing luxury lifestyles on borrowed money and pretending that it's normal. It’s not. It’s financial cosplay.

If your income doesn't back your lifestyle, you’re not balling, you’re borrowing... but just from your future. And the bill is going to come whether you like it or not.

6. Marriage: The most important decision of your life.

Your grandparents didn’t swipe right a thousand times to find the perfect picture of a partner. They valued the human... and they went out and talked to real people to find that human. Then built a foundation together. Marriage was a partnership, not a 5 season reality TV show. They shared goals, budgets, and maybe some arguments about grocery bills.

You know what’s sexy? Spending your life building a future with someone that you love and trust.

7. No one’s coming to save you

You're in charge of your life. There's no group out there that will save you if you fail.

The government won’t. Social Security might not even be around when the current working generation is ready for retirement. Your job won’t be there forever. Your vision board definitely won’t save you.

If you want financial peace, you have to earn it the way every generation before us did. Work hard. Spend less. Save more. Invest wisely. Repeat for 40 years.

That’s the whole formula. That's it... There’s no hacks, secrets, or shortcuts. Just pure responsibility, consistency, and time.

Your grandparents didn’t need AI, life-hacks, or FIRE spreadsheets to build a life. They just lived within their means, invested when they could, and stayed patient.

It’s not complicated. It’s just hard... which is why it works.

So stop overthinking it. Be like your grandparents. Be boring. Be rich.